Application of Budgets and Budgetary Control Measures in a Non-Profit Organization

Introduction

Non-profit organizations (NPOs) play a vital role in society, addressing a wide range of social, cultural, and environmental issues. Unlike profit-oriented entities, NPOs are driven by missions and objectives rather than profit generation. However, the effective management of resources is crucial for their sustainability and success. One key aspect of this management is the application of budgets and budgetary control measures. This essay explores the role of budgeting in non-profit organizations, discusses various types of budgets, and examines budgetary control measures that ensure accountability and efficient resource allocation.

Budgeting serves as a foundational tool for NPOs, enabling them to translate their mission-driven goals into actionable financial plans. By establishing a clear financial framework, organizations can prioritize their initiatives, allocate resources effectively, and measure their progress toward achieving strategic objectives. The budgeting process typically begins with a comprehensive assessment of the organization's goals, followed by the identification of necessary resources, which culminates in the development of a detailed budget proposal.

Various types of budgets are utilized within NPOs, each serving a distinct purpose. The operational budget, for instance, outlines the day-to-day expenses required to maintain ongoing programs and services. In contrast, capital budgets focus on long-term investments in infrastructure or technology that support the organization's mission. Additionally, project-specific budgets enable NPOs to allocate funding for particular initiatives, ensuring that resources are directed toward high-impact areas. By employing these diverse budgeting strategies, NPOs can enhance their financial planning and align their expenditures with their overarching goals.

Budgetary control measures are equally essential for maintaining transparency and accountability within non-profit organizations. Regular financial reporting and variance analysis allow NPOs to monitor actual performance against budgeted expectations, identifying discrepancies that may necessitate corrective action. Furthermore, the establishment of internal controls and governance structures fosters a culture of accountability, ensuring that funds are utilized efficiently and ethically. Engaging stakeholders, including donors and beneficiaries, in the budgeting process can also enhance trust and foster collaborative relationships.

In conclusion, effective budgeting and budgetary control are indispensable components of successful non-profit management. By embracing a structured approach to financial planning and oversight, NPOs can optimize resource allocation, enhance operational efficiency, and ultimately fulfill their missions more effectively. As the landscape of social needs continues to evolve, the ability to adapt and refine budgeting practices will remain a critical determinant of an NPO's impact and sustainability.

The Role of Budgets in Non-Profit Organizations

Budgets serve as a financial blueprint for non-profit organizations (NPOs), outlining projected incomes and expenses over a specific time frame. The main objectives of budgeting in a non-profit context include:

Resource Allocation: Budgets assist NPOs in allocating resources effectively based on their strategic priorities. By evaluating each program’s funding needs against the organization's overall resources, NPOs can prioritize initiatives that align with their mission and promise the greatest impact. This strategic allocation not only ensures that funds are directed toward high-priority projects but also fosters innovation, allowing organizations to explore new avenues for fulfilling their missions.

Financial Planning: A well-structured budget allows for long-term financial planning. It enables organizations to forecast future revenues and expenses, ensuring that they can sustain operations and fulfill their missions over time. This forward-thinking approach is crucial in an environment where funding can be unpredictable. By anticipating financial trends, NPOs can identify potential challenges and opportunities, allowing for proactive adjustments to their strategies and operations.

Performance Measurement: Budgets provide a standard against which actual performance can be measured. By comparing budgeted figures to actual results, NPOs can assess the effectiveness of their programs and make necessary adjustments. This process of performance measurement not only highlights areas of success but also identifies gaps where improvements are needed. As a result, organizations can continuously refine their strategies, ensuring that they remain agile and responsive to the needs of their communities.

Accountability: Budgets enhance accountability by setting clear financial expectations. NPOs are typically accountable to donors, grantors, and stakeholders who expect their contributions to be used prudently. A budget acts as a control mechanism, ensuring funds are spent as intended and that there is transparency in financial reporting. This accountability builds trust and fosters stronger relationships with stakeholders, encouraging continued support and engagement.

Strategic Decision-Making: Beyond these core functions, budgets also play a pivotal role in strategic decision-making. They provide a framework for evaluating potential projects, assessing risk, and determining the feasibility of new initiatives. By integrating budgeting into the decision-making process, NPOs can ensure that their choices are data-driven and aligned with their mission.

Budgets are not merely financial documents; they are vital tools that empower non-profit organizations to navigate their complex environments, maximize their impact, and achieve their missions with integrity and transparency. Through effective budgeting, NPOs can turn their visions into reality, ensuring that every dollar spent contributes meaningfully to the communities they serve.

Types of Budgets in Non-Profit Organizations

Non-profit organizations (NPOs) utilize various types of budgets, each serving specific purposes and tailored to meet the unique financial challenges they face. Understanding these budgets is essential for effective financial management and strategic planning.

Operating Budget: The operating budget outlines the anticipated revenue and expenses for the day-to-day operations of the organization. This budget is critical for tracking operational costs, ensuring that the organization remains financially viable, and providing a framework for decision-making. By regularly comparing actual expenses against the operating budget, NPOs can identify variances and make necessary adjustments to maintain fiscal health.

Project or Program Budget: Many NPOs operate on a project basis, and each program may have its own budget. These budgets detail the costs associated with specific initiatives, including personnel, materials, and overhead. They serve as a vital tool for monitoring project expenses and assessing their effectiveness in achieving program goals. By analyzing project budgets, organizations can determine the return on investment for various initiatives and make informed decisions about future funding allocations.

Cash Flow Budget: This budget focuses on managing cash inflows and outflows over a specific period, which is crucial for maintaining liquidity. NPOs can anticipate potential cash shortfalls and plan accordingly, ensuring that they can meet their obligations and continue operations without interruption. A well-structured cash flow budget allows organizations to navigate financial uncertainties and invest in opportunities as they arise.

Capital Budget: Capital budgets are essential for long-term investments in assets such as buildings, equipment, or technology. These budgets help organizations ensure that significant expenditures align with strategic objectives. By carefully planning capital expenditures, NPOs can enhance their operational capabilities and improve service delivery, ultimately leading to greater impact in their communities.

Flexible Budget: This type of budget adjusts for changes in activity levels, making it particularly useful in times of fluctuating revenue streams, such as during economic downturns. Flexible budgets allow NPOs to plan for varying levels of service provision and expenditure, enabling them to respond dynamically to changing circumstances. This adaptability is crucial for sustaining operations and fulfilling their mission, regardless of external pressures.

Each type of budget plays a vital role in the financial health of non-profit organizations. By implementing a comprehensive budgeting strategy, NPOs can enhance their financial management practices, ensure accountability, and ultimately drive greater impact in their communities. Effective budgeting not only supports operational stability but also empowers organizations to fulfill their mission with confidence and resilience.

Budgetary Control Measures in Non-Profit Organizations

Implementing budgetary control measures is vital for maintaining financial discipline and ensuring that non-profits operate within their means. The following measures are fundamental:

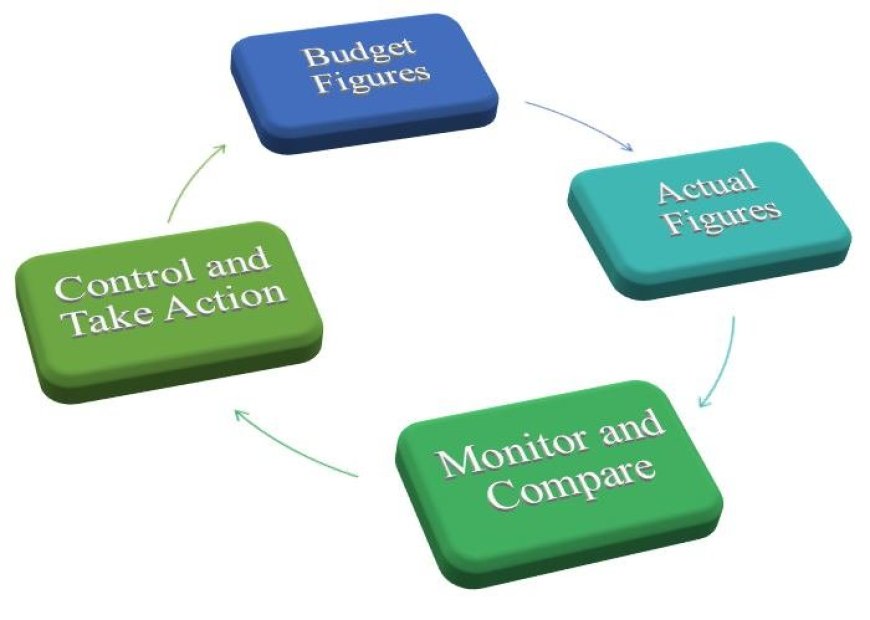

Regular Monitoring and Reporting: NPOs should regularly compare actual financial performance against budgeted figures. Monthly or quarterly financial reports enable organizations to identify variances and take corrective actions promptly. This ongoing review not only ensures compliance but also enhances the organization’s ability to pivot in response to unforeseen circumstances, such as changes in funding or shifts in community needs.

Variance Analysis: This involves analyzing the differences between budgeted and actual figures. Variance analysis provides insights into where and why discrepancies occur, allowing organizations to adjust their operations or budgets as needed. By identifying trends over time, NPOs can make informed decisions that reflect both current realities and future forecasts, ultimately improving financial sustainability.

Approval Processes: Establishing approval procedures for expenditures ensures that budgetary controls are maintained. All significant expenses should require managerial or board approval, preventing unauthorized spending. A structured approval process not only safeguards assets but also reinforces a culture of accountability within the organization, ensuring that financial decisions align with the mission and strategic goals.

Internal Controls: Strong internal controls, including segregation of duties and regular audits, help prevent misuse of funds and ensure compliance with financial policies. NPOs should have clear financial procedures to ensure accountability and transparency. Implementing robust internal controls also builds trust with stakeholders, demonstrating a commitment to ethical practices and responsible stewardship of resources.

Stakeholder Involvement: Engaging stakeholders, including board members, staff, and donors, in the budgeting process fosters a sense of ownership and accountability. Collaborative budgeting encourages buy-in and support for the organization's financial management objectives. When stakeholders are involved, they are more likely to advocate for the organization’s financial health, leading to enhanced fundraising efforts and community engagement.

Impact Assessments: Regularly measuring the impact of spending against organizational objectives helps ensure that resources are used effectively. NPOs should assess how well their programs are achieving desired outcomes based on budget allocations. By aligning budgetary decisions with measurable impacts, organizations can demonstrate their value to donors and stakeholders, thereby enhancing their credibility and securing ongoing support.

Implementing these budgetary control measures is not merely about compliance; it is about fostering a culture of financial responsibility that empowers non-profit organizations to achieve their missions effectively and sustainably. Through diligent monitoring, stakeholder engagement, and a commitment to transparency, NPOs can navigate the complexities of financial management while maximizing their impact in the community.

Challenges in Budgeting for Non-Profit Organizations

While budgets are crucial for the effective functioning of non-profit organizations (NPOs), several challenges may arise that complicate the budgeting process and hinder the achievement of their missions.

Unpredictable Revenue Streams: NPOs often rely on donations, grants, and fundraising efforts, which can be inherently unpredictable. This volatility makes it difficult to create accurate budgets and can lead to cash flow issues, especially when expenses are incurred in anticipation of revenue that may not materialize. As a result, organizations may find themselves in a precarious position, forced to make last-minute adjustments that can undermine their strategic initiatives.

Resource Limitations: Many non-profits operate with limited resources, which can restrict their ability to engage in comprehensive budgeting processes or sophisticated financial management practices. The lack of financial expertise or the absence of dedicated financial personnel can lead to oversights and miscalculations. Without adequate tools and training, organizations may struggle to forecast future needs, resulting in budgets that fail to reflect the true financial landscape.

Stakeholder Pressure: Non-profits often face pressure from various stakeholders, including donors, board members, and community partners, to allocate funds in ways that align with their expectations. This can create tension between fulfilling stakeholder demands and adhering to the organization’s strategic goals. When decisions are made primarily to appease stakeholders rather than to advance the mission, it can lead to misalignment of resources and ultimately jeopardize the organization's long-term sustainability.

Changing Regulations: Compliance with regulatory requirements can complicate budgeting processes. Non-profits must navigate a complex landscape of laws and funding guidelines that can change frequently. These shifts may necessitate adjustments to budgets, diverting attention from strategic objectives and potentially disrupting planned initiatives. Additionally, the need to allocate resources for compliance-related activities can strain already limited budgets.

Balancing Mission and Financial Health: Perhaps one of the most significant challenges is the need to balance mission-driven activities with financial health. NPOs must ensure that they are not only fulfilling their social objectives but also maintaining fiscal responsibility. This dual focus requires a nuanced approach to budgeting, one that considers both the immediate needs of the community served and the long-term viability of the organization.

While budgeting is essential for NPOs, the myriad challenges they face necessitate innovative solutions and a proactive approach to financial management. By addressing these issues head-on, non-profits can enhance their resilience and better fulfill their missions in an ever-evolving landscape.

Conclusion

In conclusion, the application of budgets and budgetary control measures in non-profit organizations is critical for achieving financial sustainability and operational effectiveness. By allocating resources wisely, providing a framework for financial planning, and establishing accountability mechanisms, budgets empower NPOs to fulfill their missions more effectively. Despite the challenges they face in budgeting, the ongoing commitment to sound financial practices can enable non-profits to navigate uncertainties and focus on delivering value to their stakeholders. By continuously improving budgeting processes and fostering a culture of financial discipline, non-profit organizations can enhance their impact and ensure that their programs are funded appropriately to achieve their goals.

References

- Allen, R. (2017). Budgeting for Nonprofit Organizations. New York: Wiley.

- Hodge, G. A. (2014). The Role of Budgeting in Nonprofit Organizations: A Case Study Perspective. Public Administration Review.

- Cagney, J. (2016). Financial Management for Nonprofit Organizations. New York: Routledge.

- National Council of Nonprofits. (2021). Nonprofit Financial Management. Online] Available at: [nationalcouncilofnonprofits.org. Accessed [Date].